July 1st, 2024

Top 5 Best AI Finance Tools

By Rahul Sonwalkar · 9 min read

For investment professional & corporate finance teams

Overview

The finance sector is currently undergoing a significant transformation, driven by an increasing focus on automation to manage the ever-growing volume and diversity of data sources. This shift is amplified by the recent advancements in generative AI technologies, such as ChatGPT, which are revolutionizing how finance departments operate. Companies are actively seeking the most effective automation solutions to stay competitive. This article highlights the top five AI tools that are reshaping the finance industry, covering areas from financial data analysis, budgeting, and forecasting to accounting, tax, and compliance. These innovative tools are enabling finance teams to shift their focus towards strategic decision-making and adding value, streamlining processes, and significantly reducing the reliance on manual tasks.

The Tools

1. Julius

2. Datarails FP&A Genius

3. Stampli

4. Quill AI

5. Trullion

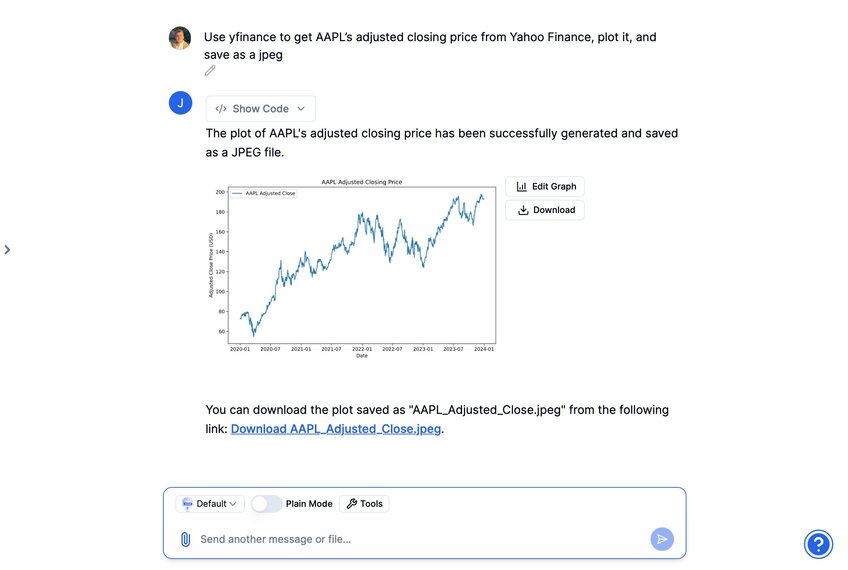

Julius AI: Best for Finance Professionals Who Wish They Knew Python

Julius offers a clean AI workspace for finance and investment professionals seeking to use Python to perform calculations, create models, and generate graphs & charts. Users simply provide instructions in everyday language, and Julius translates these into the requisite Python code, eliminating the need for programming knowledge. Whether you’re looking to plot the payoff diagram of a call option, pull treasury yields from FRED, or visualize live stock prices for a deck, Julius is a one-stop solution which has the potential to replace Excel in your workflow.

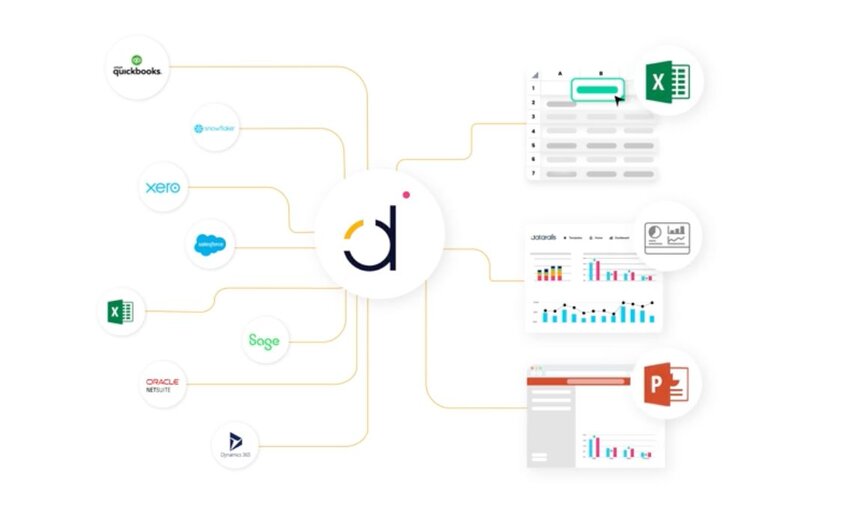

Datarails FP&A Genius: Best for Innovation-Forward FP&A Teams

Datarails, a pioneer in automating manual finance tasks, has introduced FP&A Genius, a ChatGPT-style chatbot designed to enhance the strategic capabilities of CFOs and FP&A analysts by answering complex "what if" and scenario questions quickly and accurately. This innovation is directly connected to real-time data, ensuring decisions are made with the most current information available. FP&A Genius consolidates all finance integrations and data sources into a single source of truth while promising strong data security.

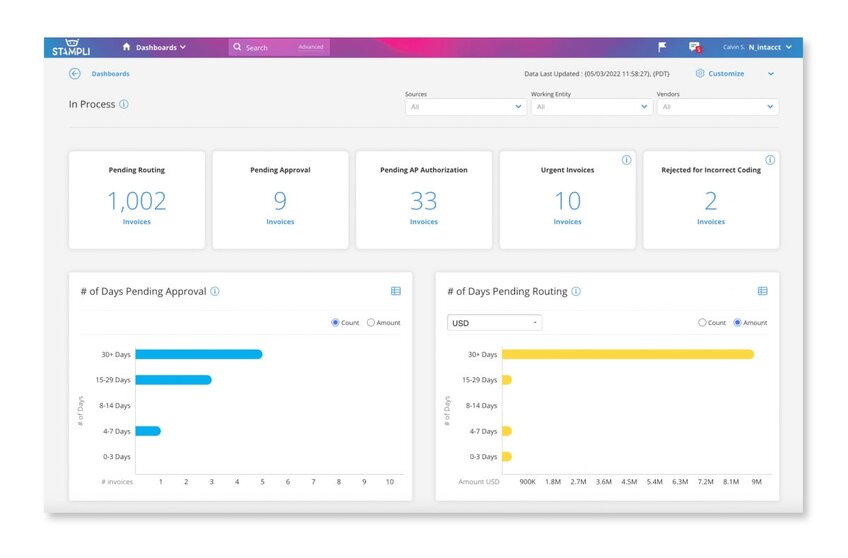

Stampli: Best for CFOs Looking to Automate AP & Invoicing

Stampli offers an AI-driven solution tailored for accounts payable teams looking to enhance efficiency and accuracy within their financial operations. By integrating seamlessly with existing ERP systems like QuickBooks, NetSuite, and Sage Intacct, Stampli provides a cohesive platform for managing invoices. Its core features include AI-powered data extraction for reducing manual input and errors, interactive invoice management to foster team collaboration and transparency, real-time audit trails for monitoring invoice activities, and AI-powered insights that learn from user patterns and vendor behaviors to offer predictive financial management strategies.

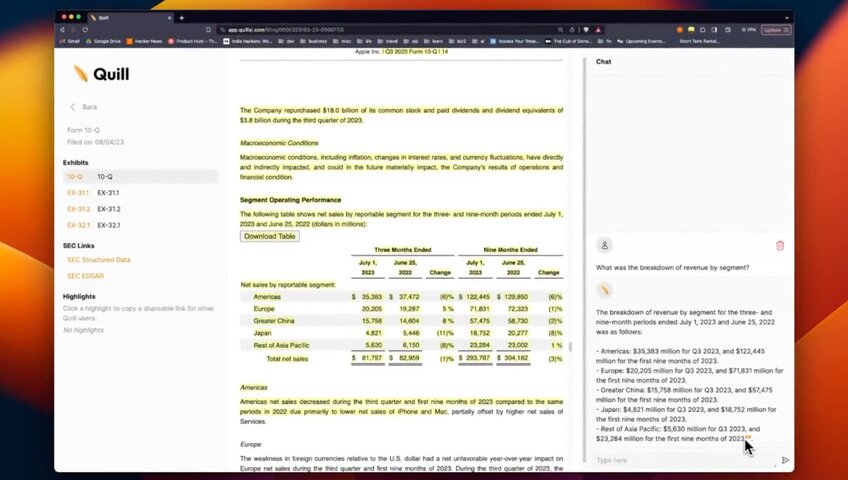

Quill AI: Best for Investment Analysts Tired of Sifting Through SEC Filings

Quill AI revolutionizes the way investment analysts interact with and analyze SEC filings & earnings calls, offering AI-powered tools to parse documents, receive SEC alerts, and generate financial models. Designed for efficiency, Quill enables users to extract vital information from investor materials and engage in conversations with financial documents, facilitating less time spent on reading filings and more on investing. Key features include the ability to chat with multiple documents simultaneously, uncovering trends and changes quickly, and an Excel add-in for seamless integration.

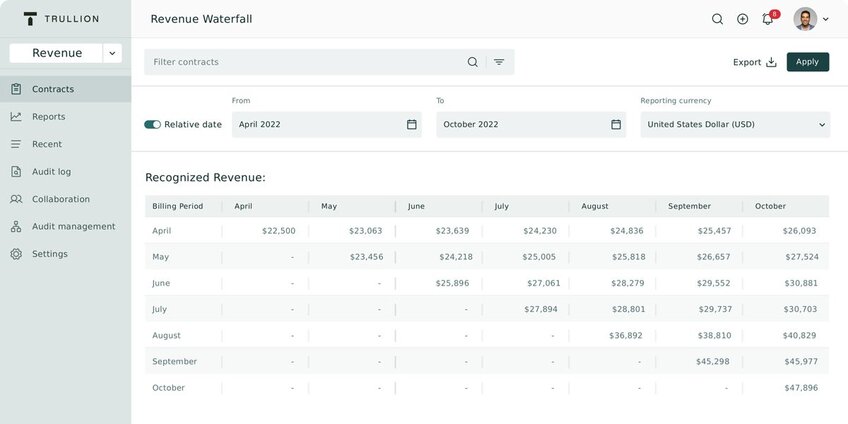

Trullion: Best for Accounting Teams Looking to Save Time on Reporting

Trullion offers an AI-powered platform designed to aid accounting teams, particularly in compliance and audit, by integrating structured and unstructured data into a single platform, streamlining the accounting process, minimizing cost inefficiencies, and ensuring compliance. Key features include an advanced auditing function that simplifies audits by providing a centralized access point to all data sources and the capability to compare documents effortlessly, significantly reducing audit times. Additionally, Trullion handles the complexities of lease contracts, using AI to extract critical data from various formats and create audit-ready reports, addressing the challenges of tracking and managing leases.

Conclusion

In conclusion, the transformative power of AI in the finance sector is undeniable, offering groundbreaking solutions that significantly enhance efficiency, accuracy, and strategic decision-making. The top five AI finance tools—Julius AI, Datarails FP&A Genius, Stampli, Quill AI, and Trullion—each bring unique strengths to various aspects of finance, from Python-based analysis and financial planning to invoice management, SEC filing analysis, and compliance reporting. These tools are not just reshaping existing workflows but are setting new standards for what finance teams can achieve. By leveraging these advanced technologies, finance professionals can transcend traditional limitations, embracing a future where automation and AI-driven insights drive unparalleled growth and innovation. As the finance industry continues to evolve, these AI tools will play a pivotal role in enabling companies to stay competitive, manage complexities, and capitalize on opportunities in an increasingly data-driven world.

Frequently Asked Questions (FAQs)

AI for fintech refers to the application of artificial intelligence technologies in financial technology to automate processes, enhance decision-making, and improve efficiency. It encompasses tools and systems designed for tasks such as fraud detection, personalized financial recommendations, risk management, and transaction processing.

Finance commonly utilizes machine learning, natural language processing (NLP), and predictive analytics. These AI types power applications such as algorithmic trading, sentiment analysis of financial reports, and fraud prevention systems, leveraging data to uncover patterns and make informed predictions.

The best use of AI in fintech lies in enhancing customer experience and operational efficiency, such as through intelligent chatbots for personalized support, fraud detection systems, and predictive analytics for risk management. These applications enable fintech companies to scale, improve accuracy, and make data-driven decisions rapidly.